Do You Need Home Excess Insurance?

Either way, If you do not have home building and contents insurance, you may be seriously out of pocket if any kind of accident strikes.

Even if you have taken the precaution of arranging home insurance, however, you are almost certain to discover that you remain financially responsible for the first part of any successful claim you may make. This is the insurance excess.

Excess

In common with many other forms of general insurance, the cover for the building and contents of your home is likely to be subject to an excess.

What this means is that for any valid claim, you are liable for paying an initial amount – the excess. This may amount to several hundreds of pounds and maybe enough on many occasions to dissuade the insured from actually making a claim on the insurance for which they have paid.

An excess effectively represents the proportion of any risks that remain uninsured, but stay with the individual seeking the cover. The excess may be used by an insurer, therefore, if there remains any doubt about the risks requested to be covered.

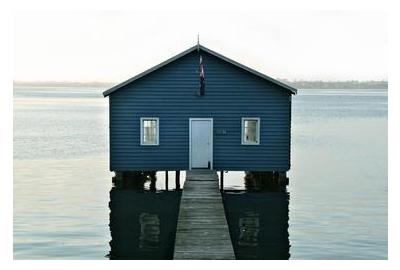

A typical example might be cover for flooding – a potentially very serious risk, especially in areas where this has been a problem in the past. It is already known, for example, that insurers are sufficiently reluctant to insure homes in areas of flood risk and increase the excess accordingly – according to a webpage published by the Department for Environment, Flood and Rural Affairs (Defra) for example.

Excess Insurance

An excess may be the insurer’s way of ensuring that the risks of any loss or damage to your home are shared – and for that reason, you may find that the cover comes with a compulsory excess amount.

More than that, however, there may be instances, when your insurer imposes a higher than usual excess to reflect the increased need to share with you the risks against which you may wish to be insured. A case in point is the location of your home in an area already known to be subject to flooding.

Whether or not this is responsible for the excess assuming a quite considerable sum, there exists a form of cover called home excess insurance designed to safeguard your liability for paying any such excess.

Home Excess Insurance

Here at Bettersafe, we are experts in the provision of standalone home excess insurance.

Not only may this type of cover ensure that your exposure to the risks of an excess payment is safely covered, but it may also give you the confidence and peace of mind in knowing that any level of excess may be similarly covered (up to pre-agreed levels) – and since a higher level of voluntary excess typically translates into lower premiums, an ultimate saving in the cost of your home insurance.